Overview of investment performance

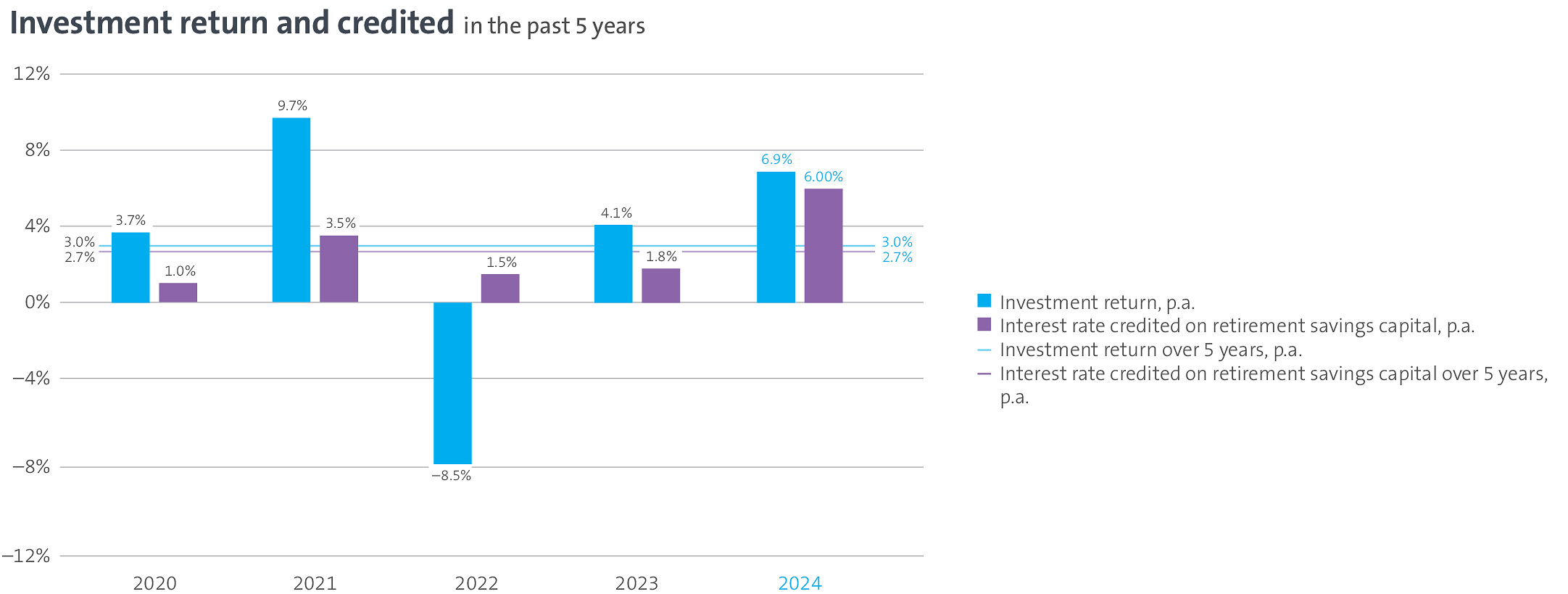

In the 2024 financial year, the investment return was +6.9%. In the last five years, an average annual return of +3.0% has been achieved (see graphic for detailed performance figures), which is above the target return for this period. The proportion of the return above the target served the further expansion of the value fluctuation reserve and an average interest rate of 2.7% was able to be applied to the retirement savings accounts of active policyholders. The positive investment result in 2024 increases the value fluctuation reserve and coverage ratio. However, the target coverage ratio of 119.0% for ensuring the promised pension benefits long term has not yet been achieved.

Eight investment categories saw positive returns; four saw negative returns. Global equities, Swiss real estate and Swiss government bonds delivered the largest positive returns. Negative drivers of returns were in particular global real estate and private market investments. In the relative benchmark comparison, this resulted in a deviation of +1.5%. The main reasons for the leap in returns in 2024 were the investment categories of global real estate (DM), Swiss government bonds and global equities, which achieved a higher return than their benchmarks.