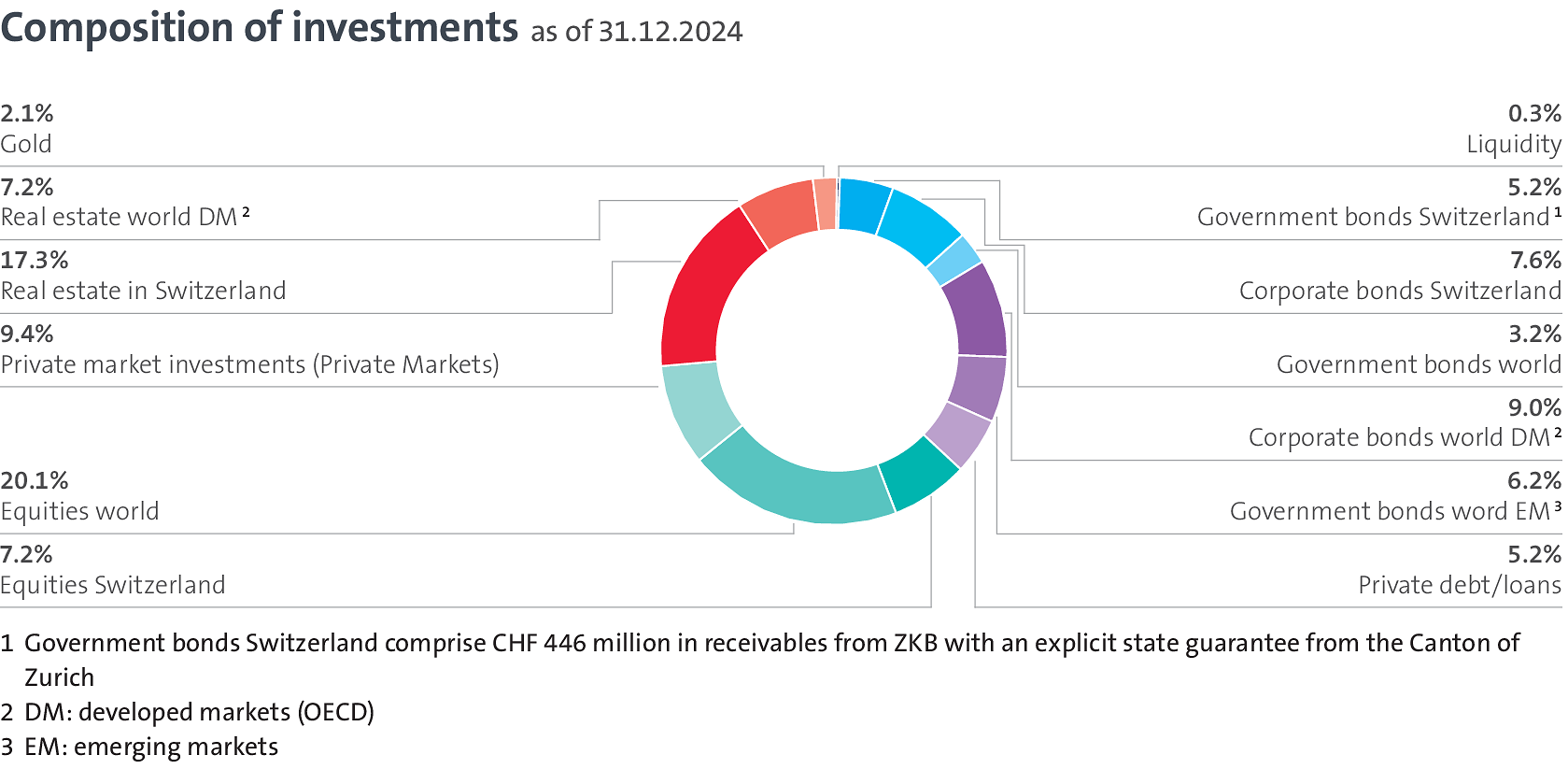

Composition of investments as at 31 December 2024

Based on the investment strategy and bandwidths adopted by the Foundation Council, comPlan invested 37% of assets in nominal values such as government and corporate bonds or loans to companies as at 31 December 2024. Bonds with high creditworthiness and comparably low returns are considered safe, as losses do not occur on a frequent basis. They are a necessary part of an investment strategy in compensating for larger fluctuations in the 37% equities and 26% fair values. Equities and fair value assets are necessary if comPlan is to achieve the return required to finance the promised pension benefits.

As the liabilities of the pension fund are incurred in Swiss francs, a considerable portion of the currency risks is systematically hedged in foreign currency investments. Total foreign currency investments amount to 62.6%. After currency hedging, the proportion of unhedged foreign currency items is still 16%.